A couple have spoken out after their savings of nearly AUD $100,000 disappeared.

Ellie Houston and Trae Murphy from Melbourne, Australia were all set to purchase a property on the Murray River and transfer AUD $96,000 ($61,000) of their savings into a Commonwealth Bank account to the Bank of Melbourne on 30 June, when a few days later the sum bounced back.

Not only that, but after another attempt, the couple later realised the sum wasn't even in their Commonwealth Bank account at all and quickly rushed to get in contact with the financial services company.

Advert

However, the situation only became more complicated from there.

Upon getting in touch with the Commonwealth Bank, the 21 and 23-year-old were shocked to hear there had reportedly never been a balance of $96,000 AUD in their account.

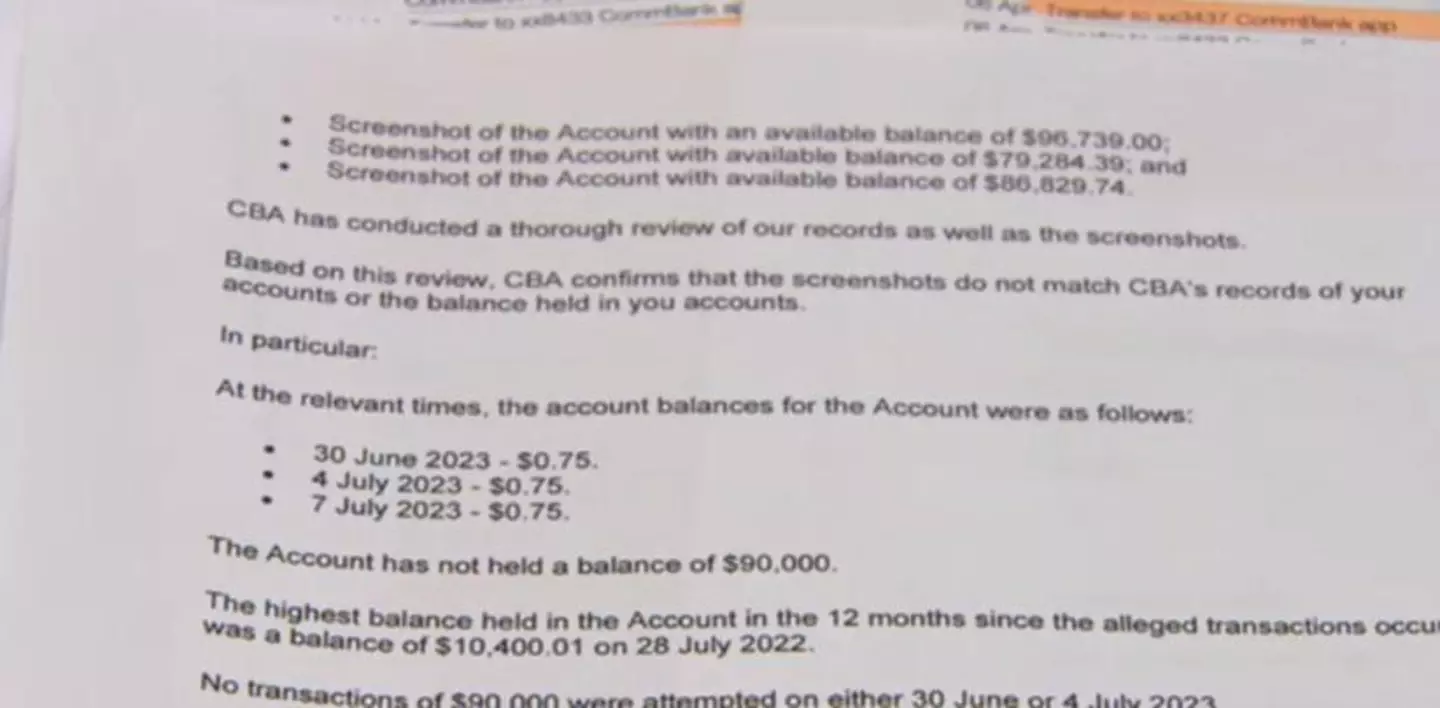

The pair provided screenshots of their bank balances on the three different dates they attempted to transfer the money, but they didn't match the bank's own records.

Advert

According to the bank, as of 30 June, 4 July and 7 July, there was only $0.75 AUD ($0.48) in the couple's account.

A letter to the couple read, as quoted by 7News: "The CBA has conducted a thorough review of our records. CBA confirms that the screenshots do not match CBA’s records of your accounts or the balance held in your accounts."

"[...] The account has not held a balance of $90,000. The highest balance held in the Account in the 12 months since the alleged transaction occurred was a balance of $10,400.01 AUD ($6,600) on 28 July, 2022."

The CBA statement also noted it had informed Murphy you can only 'transfer to another CBA account' if transferring money from a NetBank Saver account, opposed to 'another financial institution'.

Advert

The statement concluded: "Subject to receiving additional information from Mr Murphy, CBA is willing to make further enquiries."

As a result of the 'disappearing money,' the couple were forced to take out a loan so they could complete the purchase of the property they were buying - ultimately causing a delay, leading to them having to cough up an additional AUD $3,000 ($1,900) as a late settlement fee.

The couple demand to 'know how this happened' as well as wanting their 'money back' to be able to 'move past this'.

Murphy continued: "It’s just really taken a toll on the both of us. We really just want to get to the bottom of it. It feels like everything has been taken away just as we were nearly there."

Houston echoed to 3AW: "No money in our account, $0.75. [...] My partner and I have been together since we were 15 years old, we’ve saved for so long for this land, and our goal was always to pay the land off before we put a house on it, so we could then travel.

Advert

"And now everything, everything got taken from under us."

Murphy and Houston have since filed a complaint with the Australian Financial Complaints Authority.

UNILAD has contacted the Commonwealth Bank and the Australian Financial Complaints Authority for comment.

If you or someone you know is struggling or in crisis, help is available through Mental Health America. Call or text 988 or chat 988lifeline.org. You can also reach Crisis Text Line by texting MHA to 741741.

Advert

You can also call 1-800-985-5990 or text “TalkWithUs” to 66746 at the SAMHSA Disaster Distress Helpline.

Topics: Money, Australia, World News, Mental Health, News